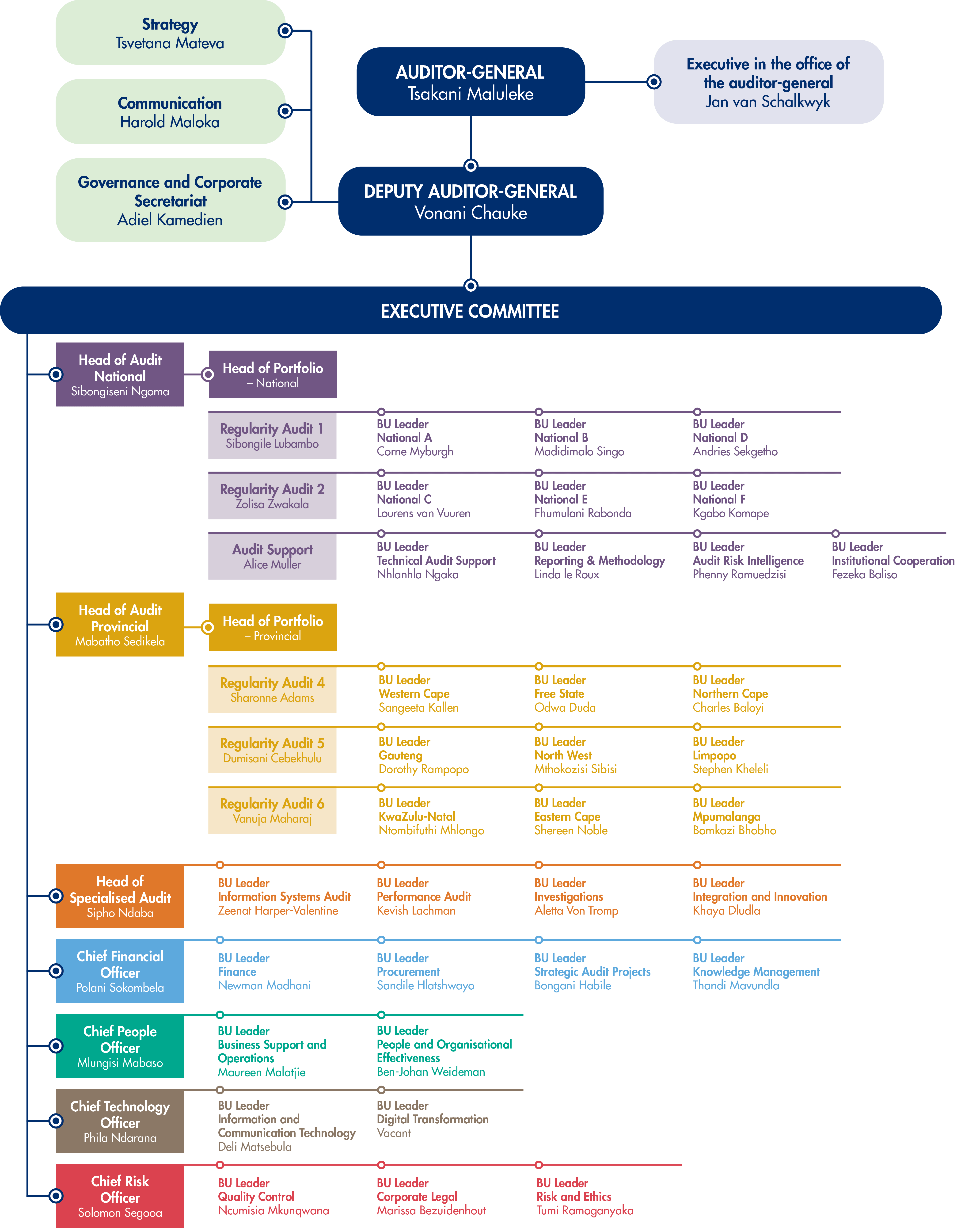

Who we are

Sibongiseni Ngoma

Head of National Audit

Mabatho Sedikela

Head of Provincial Audit

Mlungisi Mabaso

Chief People Officer

Phila Ndarana

Chief Technology Officer*

Sipho Ndaba

Head of Specialised Audit

Polani Sokombela

Chief Financial Officer

Solomon Segooa

Chief Risk Officer

Jan van Schalkwyk

Executive in the office of the auditor-general

* Phila was appointed after the 2021-22 year end.

Management structure of the AGSA

Our governance framework

Our mandate and legal form

The Constitution entrenches the AGSA’s independence, subject only to the Constitution and the law. In turn, the Constitution requires us to be impartial, and to exercise our powers and perform our functions without fear, favour or prejudice.

The AGSA is an organ of state as defined by sub-section 239(b)(i) of the Constitution, has full legal capacity and acts as a juristic person.

Accountability and reporting

We account to the National Assembly by tabling our annual report, financial statements and the audit report on those financial statements in the National Assembly. This requirement is governed by sub-section 10(2)(b) of the Public Audit Act 25 of 2004 (PAA).

Our functions, beneficiaries and products

Section 188 of the Constitution describes our functions and chapters 2 and 3 of the PAA regulates the powers necessary to perform them. By law, we audit and report on how the government spends the South African taxpayers’ money. Every year, we audit national and provincial government departments, certain public entities, municipalities and municipal entities (our auditees). We issue audit reports that provide them with the outcomes of our audits, and emphasise material irregularities where we find them.

We undertake two main types of audits: financial audits and discretionary audits, such as performance audits, special audits and investigations.

Definitions

Regularity audit, or financial audit, is our mandated examination and reporting on an auditee’s financial statements. It also examines the auditee’s compliance with relevant legislation and its reporting on its performance against its own predetermined objectives.

Specialised Audit Services is a division of the AGSA that nurtures and provides specialised skills and techniques for in-depth audits based on the auditee’s risk profile. These audits can be stand-alone or integrated with regularity audits and other discretionary audits. The three specialised audit services business units are Investigations, Information Systems Audit and Performance Audit.

Binding remedial action directs the accounting officer or authority to address cases where our recommendations are not implemented. In the case of a financial loss, the accountable officer must calculate the loss and recover it from the person responsible.

A certificate of debt is a certificate issued in terms of section 5B(1) of the Act when remedial action has not been taken. It requires the accounting officer or authority to repay the specified financial loss to the State.

All our reports are meant to help the legislature call the executive to account for the way they manage public funds.

Auditees include our financial audit reports in their respective annual reports, which they table in their relevant legislature (National Assembly, provincial legislatures or municipal councils). The reports may also be made available to bodies with a direct interest in the particular audit and to any other legislature or organ of state if we consider it in the public interest to do so.

In addition to these audit reports, we publish general reports in which we analyse the outcomes of the financial audits at national, provincial and municipal levels, and special reports that analyse our findings from real-time or other stand-alone discretionary audits.

Our organisational scale

At the end of March 2022, the AGSA employed 3 765 people, including trainee auditors and those on short-term contracts. Our actual revenue for the year ended 31 March 2022 was R4 395 million from 1 060 audits.

Our organisational structure

The AGSA is based in South Africa and delivers services that benefit the people of our country. The business operations of some of our auditees require us to audit elsewhere in the world.

Our head office is in Pretoria. We have a regional office in each of the nine provinces to ensure that we are accessible to our clients and deliver our services in the most efficient and effective manner.

The AGSA is made up of 15 regularity audit business units – one operating in each of South Africa’s nine provinces and six at a national level – three specialised audit services units, and 21 support business units (see our management structure on page 28). We use a shared services model for all enterprise resources, including financial and human capital, information and communication technology services, legal services, technical audit services, quality control, information and knowledge management, risk and ethics management, strategy management and communication.

External charters, principles and initiatives that we subscribe to or endorse

The AGSA is an active member of Intosai and participates in several of its working groups. We host the secretariat of the African Organisation of English-speaking Supreme Audit Institutions (Afrosai-e), the regional chapter of Intosai.

We subscribe to the following standards and principles:

- The International Standard on Quality Control (ISQC 1) and are preparing for the implementation of the enhanced standards ISQM 1 and 2 which will replace ISQC 1

- The International Financial Reporting Standards (IFRS)

- The International Standards on Auditing

- The International Standards of Supreme Audit Institutions (ISSAI)

- The Institute of Internal Auditors’ International standards for the professional practice of internal auditing

- The International Ethics Standards Board for Accountants (IESBA) Code of ethics for professional accountants

- The Intosai Code of ethics

- Integrated annual reporting

- Global reporting initiative

Value and benefits of supreme audit institutions

As a member of Intosai, we subscribe to the principles entrenched in Intosai-P 12, which describe how supreme audit institutions demonstrate their value and benefits to the public sector.

The goal of supreme audit institutions is to make a difference in the lives of ordinary citizens in their respective countries.

The overall philosophy of the standard centres around the following notion:

SAIs [supreme audit institutions] auditing government and public sector entities have a positive impact on trust in society because it focuses the minds of the custodians of public resources on how well they use those resources. Such awareness supports desirable values and underpins accountability mechanisms, which in turn leads to improved decisions. Once a SAI’s audit results have been made public, citizens are able to hold the custodians of public resources accountable. In this way, SAIs promote the efficiency, accountability, effectiveness and transparency of public administration. An independent, effective and credible SAI is therefore an essential component in a democratic system where accountability, transparency and integrity are indispensable parts of a stable democracy. Acting in the public interest places a further responsibility on SAIs to demonstrate their ongoing relevance to citizens, Parliament and other stakeholders.

The extent to which a SAI is able to make a difference to the lives of citizens is contingent on three main pillars:

PILLAR 1

Strengthening the accountability, transparency and integrity of government and public sector entities

- Safeguarding the independence of the SAI

- Carrying out audits

- Enabling those charged with governance

- Reporting on audit results

PILLAR 2

Demonstrating ongoing relevance to citizens, Parliament and other stakeholders

- Being responsive to changing environments and emerging risks

- Communicating effectively with stakeholders

- Being a credible source of independent and objective insight

PILLAR 3

Being a model organisation through leading by example

- Ensuring appropriate own transparency and accountability

- Ensuring own good governance

- Complying with a code of ethics

- Striving for service excellence and quality

- Capacity building through learning and knowledge sharing